Implementation of 5G services will require a trifecta of spectrum bands: low band (below 1 GHz) for coverage particularly in rural areas, mid band (typically 2-6 GHz) for capacity with reasonable coverage, and high bands (mmWave, typically above 24 GHz) for high capacity but with limited range.

Worldwide auction activity is starting to reveal the relative values of the 5G spectrum trifecta. As with earlier auctions, the value per MHz-pop declines as the frequency gets higher. With 5G, the MHz available increases by a factor of 10 for each step from below 1 GHz to mid-band to mmWave while pricing tends to follow the opposite trend.

Low Band (< 1 GHz) – Auctions in the US, Europe and Canada

Although it has relatively low capacity, low band spectrum – below 1 GHz – provides an important coverage layer for 5G. In North America, the 700 MHz and 850 MHz bands are in use for LTE/4G or 3G service, so new low band spectrum – notably 600 MHz – was needed for 5G absent re-farming.

In Europe, the 700 MHz band was initially tagged for 4G service, but has not yet been licensed in many countries. Thus 700 MHz represents a low-band opportunity for 5G in Europe. European 700 MHz licensing to date is a patchwork, with licenses awarded in France, Germany, Italy and the Scandinavian countries, with timing for an auction not yet set in other countries such as the UK, Spain, Netherlands and Ireland.

The FCC in the US licensed the 600 MHz band as part of the Broadcast Incentive Auction held in 2016-2017, resulting in an average value of US$0.93 per MHz-pop. Canada followed suit in 2019, completing the sale of 600 MHz licenses on April 4, 2019, at an average value of C$1.44 per MHz-pop (about US$1.15 using PPP currency conversion rate). The set-aside of blocks for smaller regional carriers resulted in a discount of 44% for those bidders, with large Canadian incumbents paying about twice the average $ per MHz-pop. The Canadian auction awarded licenses based on the best second-price, so as-bid values were higher than as-paid.

Mid-Band – Europe, Australia, Korea

Mid-range frequency bands attract mid-range prices. Often seen as the new sweet spot, particularly the range from 3.3 to 4.2 GHz – also known as C Band – licenses provide significant new capacity and reasonable range for deployment.

The range however is often occupied by government/military users, fixed wireless operators and satellite service providers. So while there is a full 900 MHz of spectrum, countries typically are able to free up varying amounts, but ideally with an objective of ensuring sufficient availability for 100 MHz per operator.

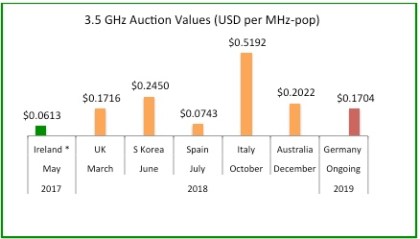

Mid-band prices have evolved since the first 5G-era auction of 3.6 GHz licenses in Ireland, awarded in 2017 for about US$0.06 per MHz-pop (including annual usage fees). Since then values have been trending upwards, from US$0.07 in Spain, to US$0.20 in Australia, US$0.24 in Korea and US$0.52 in Italy (currencies converted on a PPP basis). The German auction, still ongoing after 209 rounds, is about US$0.17 per MHz-pop (PPP basis).

mmWave – US leading the way

Filling out the trifecta are the mmWave bands, providing tons of capacity but at very high frequencies. The FCC in the US started the ball rolling for mmWave with its 28 GHz auction in late 2018 focusing on a subset of the country. It just wrapped up a second auction, of 24 GHz licenses, in April 2019.

Values in these auctions, on average are in the range of US$0.01 per MHz-pop, interestingly a bit less for 24 GHz which covers the entire country compared to 28 GHz which was mostly auctioned for smaller markets. This difference may be due to current views on equipment availability or to the concerns raised about interference with weather data transmitted in an adjacent band. In any case, the mmWave story is still unfolding in the US, with a new blockbuster auction of 3400 MHz just announced for the bands 37 GHz, 39 GHz and 47 GHz, to take place in December 2019.

LYA has supported bidders in many spectrum auctions, and provides valuation modelling services and assessment of license values in secondary transactions. LYA conducts private sales of licenses or other assets. Please contact us to discuss how we can add value and be of service.