How much spectrum is required for 5G? The short answer is a lot. The detailed answer varies according to each carrier’s spectrum holdings but most carriers will need to double or more than double their spectrum holdings to offer quality 5G services. Spectrum in different bands will also be required for coverage and capacity… low, mid and upper bands.

Verizon created quite a surprise when it was revealed that it had not participated in the 600 MHz Broadcast Incentive Auction, stating it is instead focused on higher band spectrum for 5G. Of note, Verizon has an option to buy 28 GHz mmWave licenses as part of its acquisition of XO Communications and reportedly overbid AT&T for 28 GHz and 39 GHz licenses owned by Straight Path Communications. The Straight Path licenses in the 39 GHz band alone could provide in excess of 600 MHz of capacity in many key US markets, more than the total current spectrum holdings of any US or Canadian carrier.

And AT&T’s interest in the 600 MHz auction was only marginally greater than that of Verizon, presumably aided by AT&T’s recent win of the FirstNet public safety network, that came with additional 700 MHz spectrum.

On the other hand, a number of carriers have publicly expressed the need for low band spectrum for 5G coverage. As part of its 5G announcement, T-Mobile USA stated its intent to deploy mobile 5G using its newly acquired 600 MHz licenses and that it fully expects all spectrum bands to be used for 5G. T-Mobile USA now holds an average of 41 MHz of low band spectrum as of the conclusion of the 600 MHz auction, of which 75% is in the 600 MHz band. This is key to providing widespread coverage for mobile 5G.

T-Mobile USA also holds licenses in the 28 GHz and 39 GHz bands, as a result of its 2012 acquisition of MetroPCS in addition to various mid-band spectrum assets.

As with the other “G”s, 5G implies deployment via more than one range of frequencies – low band for coverage, higher bands for capacity. A key band emerging for 5G – particularly following decisions in Europe last year – is the 3.5 GHz range.

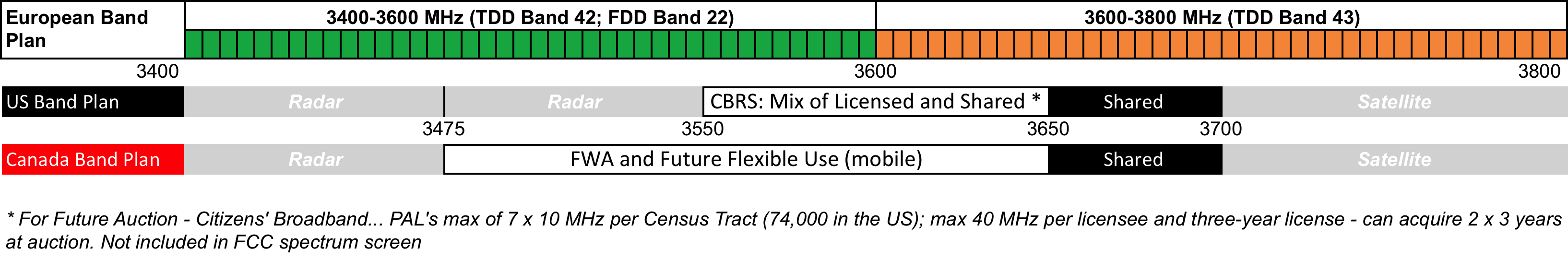

The FCC’s current plans for 3.5 GHz (100 MHz available, with a mix of short term licenses and shared use) are in stark contrast to the planned use of this spectrum range in the EU where key countries are turning their attention to awarding up to 400 MHz of prime 5G spectrum using Bands 42 and 43. Ireland is one of the first ones out of the gate putting 350 MHz up for auction.

The figure below illustrates the differences between band plans in the USA and the EU alongside the current Canadian band plan, the latter with significant similarities to the US band plan.

Figure 1 – Comparison of Band Plans in the 3.4 to 3.8 GHz Spectrum Range

The Canadian government has up to now been very quiet regarding its policy for the vast but finite spectrum resources it controls that are a necessity for 5G deployment.

However, one should expect that every band to be awarded from now on could or will be deployed with 5G in the near to short term. There is also a fair amount of higher band mmWave spectrum in Canada that could be acquired or deployed with 5G in the not too distant future.

The 5G race is on in the US and Europe but the starter’s pistol seems to have been misplaced in Canada. We expect that it will be found shortly.