On August 16, 2024, the FCC issued a Notice of Proposed Rulemaking (NPRM) which could result in a substantial overhaul of the operations of the Citizen’s Broadband Radio Service (CBRS) in the 3.5 GHz range.

Licenses for CBRS were auctioned by the FCC in 2000 (Auction 105). As the FCC notes, winning bidders included entities that do not normally participate in spectrum auctions, including cable operators, WISPs, electric utilities, energy and enterprise companies, as well as the nationwide and regional mobile network operators. More than 20,000 licenses were sold to 228 bidders, a record for FCC auctions.

The FCC has already made some changes to CBRS, in order to ease the burden of dealing with protection areas for government users. The new NRPM would go further, notably opening the possibility of harmonizing power levels and out-of-band emission limits with the neighbouring 3450 MHz (Auction 110) and C-Band (Auction 107) frequency ranges.

This would make CBRS an integral part of the 3GPP 5G band n77, which stretches from 3300 MHz to 4200 MHz. The NPRM also proposes possible modifications to the protection mechanism, which the FCC notes is currently more stringent than the approach used in the 3450 MHz band, which protects government incumbents using more conventional coordination procedures.

One major element not addressed in the NPRM is the 40 MHz limit for PAL licenses, i.e. maximum of 4 licenses of 10 MHz each per operator. While PALs can be combined with GAA to increase capacity, GAA access is shared and not necessarily always available. Creating larger channels – from 50 MHz up to 100 MHz in 5G – brings significant commercial value to fixed as well as mobile operators who may want to use CBRS for 5G. This could be an added element for the FCC to focus on in its overhaul of the CBRS framework.

Implications for License Valuation

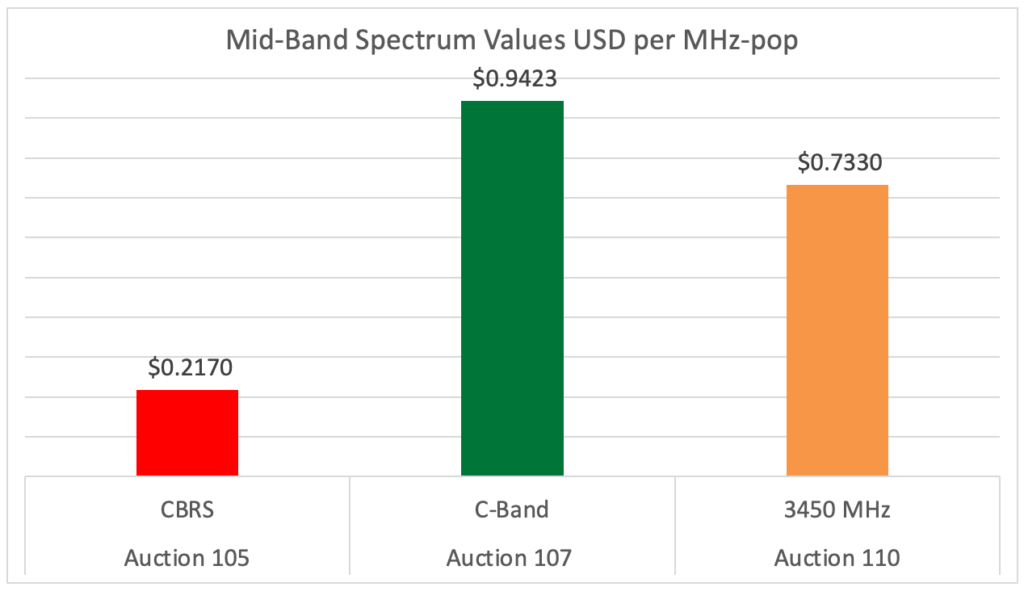

The shared nature of CBRS with lower power levels and protection scheme likely dampened commercial interest in the band, leading to low prices seen in Auction 105. Technical changes to harmonize CBRS with its mid-band neighbours, and placing it squarely in the international n77 ecosystem for 5G, could have a positive impact on the usefulness of this spectrum and on its value.

CBRS PAL licenses sold for 22 cents per MHz-pop, 1/4 of the value of C-Band licenses and 30% of 3450 MHz.

If CBRS licenses become more technically comparable to other mid-band licenses, this is likely to create greater interest from a variety of operators for both fixed and mobile 5G deployment. Re-calibration of CBRS license values could represent a significant bump-up.

BEAD, CBRS and LEOs

In an apparently unrelated development, the NTIA on August 26, 2024 announced it is seeking comment on BEAD’s Alternative Broadband Technology Guidance. This guidance, already set out in the May 2022 NOFO, states that “Eligible Entities may select a proposal for an Alternative Technology only where there is no Reliable Broadband Service technology meeting the BEAD Program’s technical requirements…” and in “such cases, an Eligible Entity is authorized to select a proposal involving a less costly technology for that location, even if that technology does not meet the statutory definition of Reliable Broadband Service but otherwise satisfies the BEAD Program’s technical requirements.”

The NTIA consultation could result in greater access to BEAD funding for alternative technologies such as LEO satellite offerings, identified by the NTIA as not reliable. CBRS, on the other hand, using GAA alone or in combination with PALs already meets the requirements for FWA as reliable according to the NTIA and the FCC. The CBRS deployment model of using a licensed PAL as an anchor band, and GAA to add capacity means that CBRS is a competitive alternative to fiber or HFC deployment, and also to LEO satellite approaches. Interestingly two thirds of CBRS deployments already combine the use of PAL and GAA licenses, per the FCC.

These two dimensions to CBRS – potential changes to the FCC technical rules, and the evolving NTIA BEAD criteria – stand to breathe more life into CBRS deployments, for both 5G fixed and mobile wireless .

It also means that competition from CBRS and LEOs could be real in some areas targeted by fibre-based operators for BEAD funding applications. A good competitive analysis of wireless, LEO vs fiber should be top of mind for anyone looking to submit BEAD applications.

Please contact us for more information and on how we can support you in your BEAD funding applications as well as spectrum-based businesses. LYA’s core competencies include support in obtaining broadband funding, assessment of spectrum opportunities, license valuation and support in regulatory and policy processes, including auctions.